OR

BFIs’ increased lending against shares failed to boost share market in the first nine months of current FY

Published On: May 17, 2024 08:03 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, May 17: While the banks and financial institutions (BFIs) of Nepal have been struggling to increase the real estate sector loans, they were able to issue loans against shares by a notable amount in the first nine months of the current fiscal year.

The records with Nepal Rastra Bank (NRB) show that the issuance of margin loans by BFIs increased 12.9 percent during mid-July 2023 and mid-April 2024. The real estate sector loans by the BFIs increased only 4.3 percent during the review period.

As of mid-April in the current fiscal year, the BFIs issued margin loans of Rs 86.18 billion to investors in the share market. During the nine-month period, the BFIs invested an additional Rs 9.88 billion under the heading.

In the review period, the BFIs issued additional loans totaling Rs 208 billion to the private sector. The share loans made 4.75 percent of the total loans.

The BFIs issued an additional margin loan worth Rs 7.89 billion in the category of share loans of more than Rs 10 million, while the figure was Rs 234.6 million for share loans between Rs 5 million and Rs 1 billion. Likewise, the BFIs issued margin loans of Rs 1.40 billion for the limit of Rs 2.5-Rs 5 million and Rs 340 million for the limit of up to Rs 2.5 million.

According to the NRB, the margin lending in the loans threshold of more than Rs 10 million increased by 17.7 percent and that in the group of Rs 2.5-Rs 5 million grew by 11 percent. BFIs’ credit issuance in margin loans mainly increased in the first half of the current fiscal year, while the rate slowed during mid-January and mid-April.

Despite the BFIs injecting a notable size in the margin loans, it could not improve the confidence of investors in the country’s only secondary market. According to the Nepal Stock Exchange, the share market index declined to 2,006.53 points as of mid-April 2024 from 2,097.10 points in mid-July 2023.

You May Like This

Majority of BFIs struggle to enforce cyber safety measures on the digital transactions: Experts

KATHMANDU, Feb 19: Nepal Rastra Bank (NRB) has enforced the ‘Cyber Resilience Guidelines’ since August 2023 targeting to improve the... Read More...

NRB seeks to invest Rs 2 billion in BFIs' fixed deposits

KATHMANDU, Sept 5: The Nepal Rastra Bank (NRB) intends to invest Rs 2 billion of the Retirement Fund in the... Read More...

Banks to remain open during isolation period

KATHMANDU, March 23: Issuing a circular on Sunday, the Nepal Rastra Bank (NRB), has asked all types of banks and... Read More...

-1200x560_20231207135130.jpg)

Just In

- Impacts of climate change on the livelihood of Dhimal women in Jhapa

- Nepal exports handicrafts worth Rs 3.27 billion in current FY

- Special Court sentences LDT engineer to six years in prison for corruption

- CIB arrests one more person in connection with HyperFund scam

- KMC rescues child laborer from house of provincial lawmaker Sharma, files complaint against her

- NEPSE sheds 9.32 points; daily turnover posts five-month high of Rs 6.44 billion

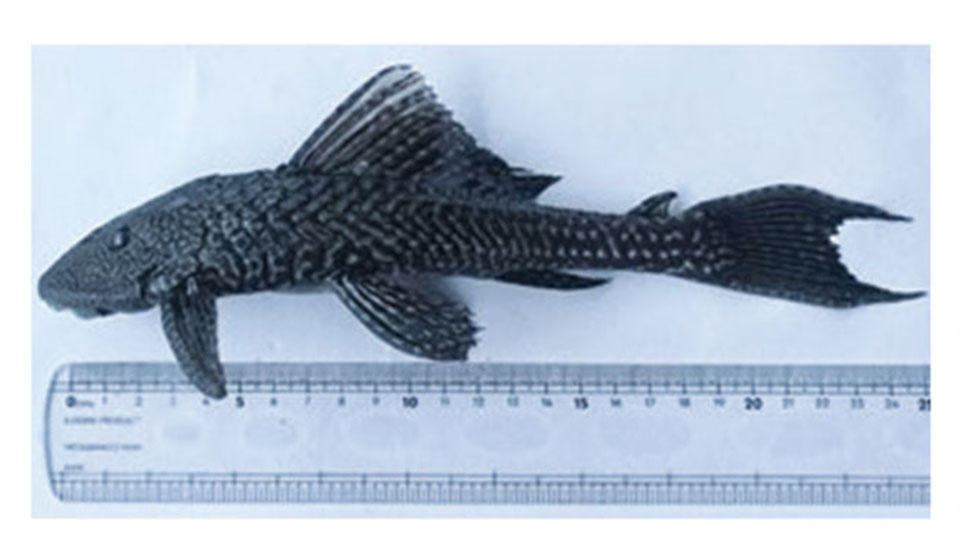

- New non-native fish species found in river in Morang

- Bangladesh and the Netherlands to face off in ICC T20 World Cup today

Leave A Comment